Asset Building & Policy

Policy

Hawai‘i families need asset-building policies that help them build financial security to withstand difficult times; create opportunities for themselves and their children; and leave a legacy for future generations to have a better life. With this in mind, Hawai‘i needs a comprehensive set of public policies to help people build assets. This should include a package of programs, tax incentives, regulatory changes, and other mechanisms to help people earn more, save more, protect hard earned assets, start businesses, and become homeowners.

Prior to the formation of the Ho`owaiwai Network, members of the network worked as a loose group of individuals, groups, organizations and agencies on issues related to asset building. In 2004, a core group of members started to organize and advocate around policies that help families and communities build and save assets. In 2007, the group increased its membership and successfully introduced an asset-building policy package to the Hawaii State Legislature. At the same time, members started to push for asset-building policies at the local and federal levels. Since then, asset-building policies have gained awareness and momentum at the local, state, and federal levels.

Accomplishments

In 2004, HACBED published Waiwai: An Asset Policy Initiative for Hawaiʻi that described the state of asset policy and why asset-building policies are needed for Hawai`i’s families and communities. It also lays out the six key goal areas of a comprehensive asset-building policy framework for Hawai`i: make work pay, teach asset building, break down barriers to asset building, help people save, help people start businesses, and help people by homes. This was followed by the publication of Hoʻowaiwai: Asset-Building Policy for Hawaiʻi report in 2006.

Building off the Hoʻowaiwai report, in 2008 HACBED published an Asset Policy Roadmap: A Strategy For Advancing Financial Security & Opportunity In Hawaiʻi which outlines four asset policy priorities that would significantly help working families in Hawaiʻi build wealth and assets. The policy priorities include: enhancing financial skills of low- and moderate-income families in Hawaiʻi; removing the disincentives to save resulting from asset limits in public benefit programs; enacting a state Earned Income Tax Credit to help make work pay; and providing state support for matched savings to help people save for a home, business, or education.

In 2008, the Hawai`i State Legislature passed a resolution to create an Asset Building and Financial Education Task Force. HACBEDʻs final report published in 2010 includes the Task Force’s policy recommendations on asset-building strategies and mechanisms for: [1] universal matched savings accounts for newborns, [2] statewide standards for financial and economic education for public and private employees, and [3] the elimination of asset limits as a bar to eligibility to public benefits programs.

Over the past several years, Network members have achieved a number of strong legislative successes, including:

- Grant-In-Aid to establish Volunteer Income Tax Assistance (VITA) sites across the state.

- A study conducted by the auditor’s office to analyze regulating predatory and payday lending.

- Funding for Section 8 and Family Self Sufficiency (FSS) homeownership programs to help families transition off rental assistance directly into homeownership.

- Exempting FSS escrow accounts that help families buy homes from benefit eligibility tests. Establishment of a self-sufficiency standard by the State Department of Business, Economic Development and Tourism to create and maintain a self-sufficiency standard for Hawaiʻi.

- Splitting of state tax refunds so taxpayers have the option to split their tax refunds into up to three checking or savings accounts to assist them with saving and building their assets.

- Establishment of a State Asset Building and Financial Education Task Force that explored asset policy strategies focused on: financial education for public and private sector employees and in K-12 grades in schools; asset limits; and universal children’s savings accounts.

- In 2013, Hawaiʻi became the seventh state to eliminate the asset test for the Temporary Assistance for Needy Families (TANF) program.

- The Hawaiʻi State minimum wage will rise from $7.25/hour in 2014 to $10.10/hour by January 1st, 2018 through incremental annual increases.

- In July 2017, through the signing of HB 209 a State Earned Income Tax Credit (EITC) was established. The State EITC is 20% of the federal EITC and non-refundable.

Individual Development Accounts &

Children’s Savings Project

HACBED served as fiscal sponsor and management agent for Hawaiʻi Individual Development Account Collaborative (1998-2001), a collaborative of IDA practitioners and funders that provided restricted matched savings for low income individuals. Nearly 500 IDAs were opened; over $500,000 in participant savings amassed with an earned match of nearly $800,000; more than 73 small businesses were started or expanded, 49 participants became first-time homeowners; and 53 participants acquired a post-secondary education.

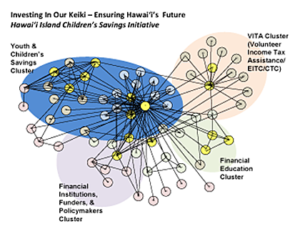

The Children’s Savings Project on Hawai‘i Island helped children open and maintain a savings account so they develop and maintain a lifelong behavior of savings. Children that participate in the project receive $5 to open a savings account and are encouraged to save a goal ranging from $30 to $50 over the school year. Once they achieve their savings goal, they are able to receive a bonus of $20. The key objective of the project is for children to develop a savings behavior early in life so they are able to build and maintain assets while ensuring economic security and well-being for the future.

Family and Individual Self Sufficiency Program & Volunteer Income Tax Assistance

A statewide network of organizational partners help to provide free tax assistance services to low-to-moderate income workers and their families every year. The free tax assistance program, titled Volunteer Income Tax Assistance (VITA), helps individuals and families to claim the Earned Income Tax Credit (EITC), child tax credit, and other valuable tax credits that help families pay off debt, save, and build assets. Approximately $40 million dollars of EITC monies are missed by Hawai‘i families every year, because they do not file for the EITC.

For more information on VITA click here.

Hawaiʻi Asset Building Conferences

In December 2010 and June 2012 HACBED and the statewide Ho`owaiwai Network convened local and national asset building leaders in statewide symposia. A symposium, according to the American Heritage Dictionary, is “a convivial meeting for drinking, music, and intellectual discussion among the ancient Greeks.” True to the spirit of HACBED, these symposia created a space for people to engage in meaningful dialogue, relevant to the work and driven towards action, having fun all the while.

Each symposium brought together a diverse range of caring individuals from communities – families, youth, policymakers, community practitioners, financial institutions, employers, resource partners – who were interested and passionate about organizing around actions that address asset poverty and building the wealth and financial stability of Hawai`i’s working families to empower themselves to increase their self-sufficiency. Participants came from every island and guests from across the nation – all of whom were and still are asset building experts in their own right. Each symposium served as a space to share, collaborate, and discuss strategies and tools for action to increase family and community assets within the unique context of Hawai`i.

Springboard To Prosperity: Building the Financial Stability, Wealth, & Well-Being of Hawaiʻi’s Working Families (December 9 & 10, 2010)

This day-and-a-half statewide symposium brought over 200 local and national experts from all walks of life together in Kailua-Kona, Hawaiʻi Island to share and build genuine wealth together, the Island way. Sessions included:

- Discussions on innovative ways that credit unions, schools and nonprofits partner to help youth open accounts and save.

- How different models of financial education training help families to meet monthly expenses while planning for the future.

- Identifying and organizing around asset building campaigns and actions at the State, Local, Community, and Family levels.

San Francisco Treasurer and then Co-Chair of the National Cities for Financial Empowerment Jose Cisneros was the keynote speaker. Cisneros shared what local governments were doing to help families save, increase financial literacy, and find jobs in their communities.

Kahua O Ke Ola: Foundations for Prosperity (June 27-29, 2012)

This three-day symposium brought together more than 75 local and guest presenters to speak to over 300 participants. The presenters shared best practices and lessons learned around family and community financial empowerment strategies and initiatives relevant to the unique context of Hawaiʻi and our unique foundations of prosperity –ʻāina, aloha, and ʻohana. Sessions included:

- Exploring family and community financial empowerment issues such as education and saving strategies for children and youth asset building

- Financing and funding strategies to support micro/small business development and community-based ventures

- Embedding asset building strategies into social service and public sector programs

- Food and agriculture as critical entry points for financial empowerment

- Financial protection and preservation strategies

The symposium also included learning tours to:

- Waiʻanae – ʻĀina Based Edu-preneurial Approaches

- Kakaʻako – Seeds of Growth in Kakaʻako: Equitable Development in the Urban Core

- Kualoa & Heʻeia – Ahupua`a Management Techniques

- Kalihi Valley – The Health & Wealth Connections

- Papakolea – Developing Strategic Partnerships

Sponsors & Supporters

- Hawaiian Homes Commission

- Kosasa Foundation

- Pacific Asian Center for Entrepreneurship (PACE)